Criteria will be stricter in 2024 for those acquiring income from three or more short-term rental properties, as they will be obliged to register at the tax offices as business people who have to collect VAT tax. Specifically, those who rent out three or more properties (over 7,000 owners) will have to change status and become business owners, paying for insurance fees, an annual freelancer fee (telos epitidevmatos) and VAT on every property. Some 102,422 individuals who own 141,452 properties will have to include in their rentals a visitors’ and an environmental fee.

Owners who are not registered on the Short-Term Rentals Registry will be fined with high annual fines equal to 50% of their gross income for the year they did not register. The minimum fine is 5,000 euros, while the owner or manager of the short-term rental has to fulfil his or her obligations within 15 days. The definition of short-term rentals is one not exceeding 60 days, and the limit relates to each rental agreement.

In addition, those buying properties are obliged by law to carry out purchases through a bank account, since transactions involving cash will invalidate the contracts. Violations of this requirement for those who carry out their transactions in cash will incur fines up to 500,000 euros.

Tax cuts

At the same time, those who insure their homes for natural catastrophes will see a 10% reduction in their new property tax (ENFIA) bill, a measure expected to affect over 1 million properties. Natural catastrophes include fire, earthquake, and floods.

Under new provisions this year (2024), those who repair or upgrade their homes as of January 1, 2024 will be granted a tax cut amounting to a maximum of 3,200 euros per year for five consecutive years. The repairs/upgrades tax cut includes expenditures, as long as they do not exceed one-third of the expenditures for received services.

Property transactions will be further facilitated this year with the start of the Digital Folder of Property Transfer (through the gov.gr web portal: https://akinita.gov.gr), which will simplify procedures and cut down on red tape. Amendments related to property transactions can be filed online through the myProperty platform, with exceptions.

Official prices

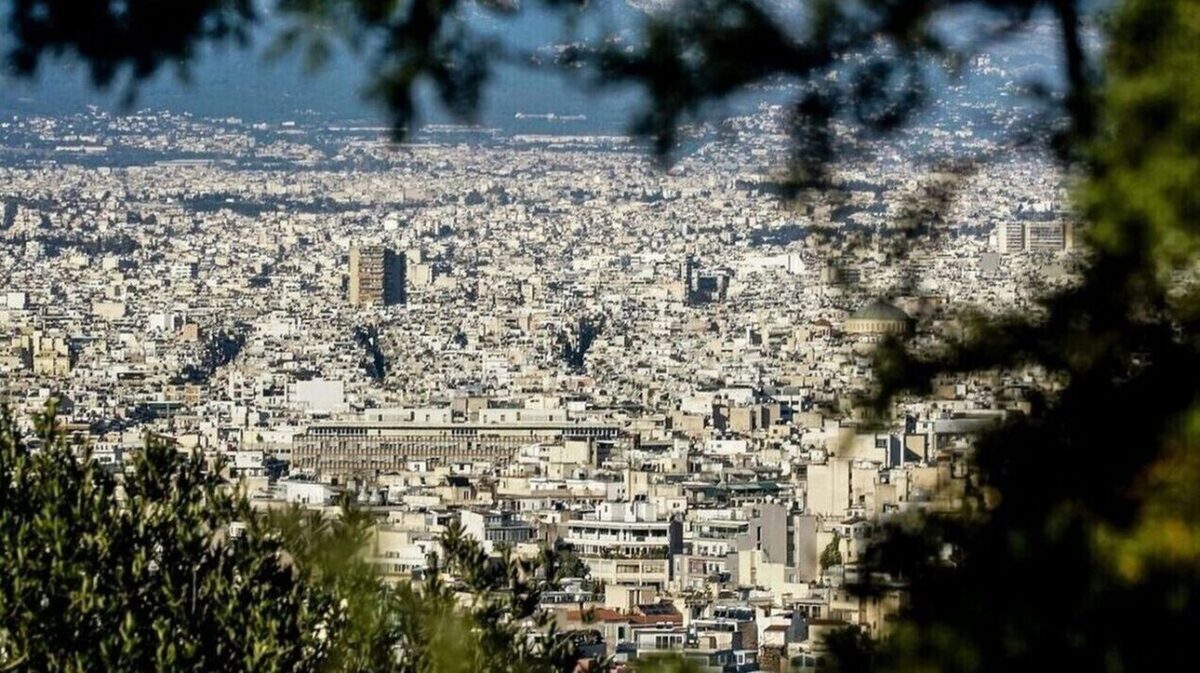

Nearly two years after the new official property prices went into effect for all of Greece, data in the property transfer registry reveals that the spread between official (‘antikeimenikes’, or ‘objective’) prices and market prices has increased, especially in central Athens, northern and southern suburbs of Attica Region, Piraeus, and Thessaloniki.

According to government plans, a new adjustment to official prices is expected in 2025, using a new automated system of mass property evaluation. The system is expected to be operable by the end of 2024, and will use property market data and trends to official prices upward to the level of market prices.

Meanwhile, nearly half the municipalities of Greece have applied for adjustments to official prices at the Finance ministry. The committee examining requests expects to complete the reviews by end February. Private assessors will suggest adjusted prices in areas where official prices are too high, compared to those in effect since January 1, 2022.